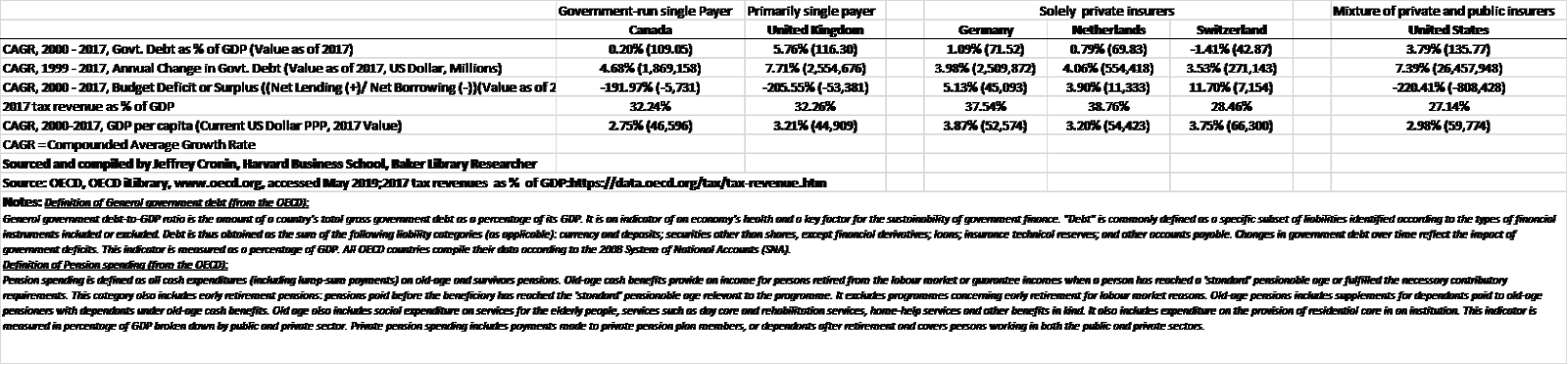

Budget & Debt Results of Public vs. Private Health Care Options

Germany,

the Netherlands, and Switzerland do not achieve their good fiscal status by

shortchanging the poor. They offer generous subsidization of those who

cannot afford the plans. It is likely funded by their taxes, whose rates, as shown in the Table, do not appear to unduly constrain GDP or its growth.

What

accounts for the better fiscal metrics of countries that achieve universal

coverage solely with private insurers? There is no simple answer. The economy

is complex and affected by many factors; but among them is that their

private health insurers cannot borrow from taxpayers and government debt buyers. If the expenses of private

insurers exceed their revenues, eventually, they go broke.

If

we were to emulate them, we should do so with the recognition that, although these countries rely entirely

on private insurers, they restrain their ability to freely compete:

- The German system requires insurers to offer uniform prices and benefits. Their barely differentiated plans compete primarily on the basis of their service levels. Further, German consumers pay for them mostly through taxes, not directly, as in a competitive market. But because their private plans can, and have, gone broke, they have incentives to be competitive.

- In contrast, the Dutch mostly pay directly, and substantial price competition exists in their additional insurance markets; but the government steps in to claw back or top off the private insurer profits it considers excessive or insufficient in the basic insurance market. Their system is appropriately titled “managed competition”

- The Swiss exhibit the best fiscal effects with private insurers whose financial results are least interfered by the government, are directly purchased by consumers, and that offer some differentiation in plan features.

These fiscal results are also affected by the Swiss 2003 rule that requires a balanced budget over the business cycle, although they preceded the adoption of this rule, and by uniform payment for all physicians, as negotiated with their union. And, as shown in the Table, despite its fiscal discipline, Switzerland has rapidly rising health care costs that may reflect not only the preferences of its users (health care costs typically grow with GDP) but also the government’s decision to subsidize inefficient hospitals.

Yet, even with these limitations in the workings of a

competitive private insurance market, these countries achieve substantially

better budget and debt results than those with government run health

insurance systems, akin to Medicare for All.